Margin trading is a strong tool that allows traders to amplify their current market publicity by borrowing resources to trade assets. While it may possibly likely lead to greater revenue, Additionally, it comes along with enhanced chance. Comprehension how margin buying and selling operates, its Positive aspects, and its dangers is vital for anyone looking to navigate this fiscal system correctly. This information delivers an in-depth evaluate margin buying and selling, how to utilize it properly, and The main element issues to bear in mind.

What exactly is Margin Trading?

Margin trading includes borrowing income from a broker to trade money property, such as stocks, currencies, or commodities. The cash borrowed are used to raise the sizing of your investing placement, allowing you to regulate a larger level of the asset than you could potentially with just your own personal capital. This leverage can magnify the two your prospective gains and your probable losses.

How can Margin Investing Operate?

Opening a Margin Account: To engage in margin investing, you should open up a margin account with a brokerage. This account differs from a daily trading account since it permits you to borrow resources from the broker.

Leverage and Obtaining Electric power: Leverage is expressed as being a ratio, for instance two:1 or 10:one, indicating the proportion of borrowed resources to your own personal money. One example is, with two:one leverage, you may control $twenty,000 value of belongings with just $10,000 of your very own funds. This boosts your getting electric power along with the likely return on financial investment.

Margin Necessity: The margin requirement is definitely the bare minimum volume of your individual funds you will have to deposit to open up and preserve a place. This is often a percentage of the overall trade value. As an illustration, a fifty% margin prerequisite signifies you need to deposit $five,000 to regulate $ten,000 really worth of assets.

Desire on Borrowed Resources: If you borrow dollars to trade on margin, the broker fees desire within the borrowed cash. This interest is frequently calculated daily and might have an impact on your profitability, particularly when you maintain positions in excess of prolonged intervals.

Margin Phone calls: If the value of your posture falls and also your account equity drops down below the required margin stage, the broker may perhaps difficulty a margin simply call. What this means is you have to deposit extra money or provide some property to deliver your account back into the demanded stage. Failure to satisfy a margin phone may end up in the broker liquidating your positions to protect the financial loan.

Benefits of Margin Investing

Greater Market Exposure: Margin investing permits you to control greater positions with considerably less cash, likely growing your returns.

Small-Providing Prospects: Margin accounts allow you to limited-sell, or wager in opposition to an asset, profiting from declines in its price.

Diversification: With a lot more acquiring ability, you may diversify your portfolio throughout distinctive belongings, decreasing the chance connected to any single expense.

Possible for Better Returns: The leverage furnished by margin trading can amplify your gains if the marketplace moves within your favor.

Risks of Margin Buying and selling

Greater Losses: Whilst leverage can maximize profits, it might also amplify losses. If the industry moves towards your situation, you may eliminate more than your Preliminary financial investment.

Margin Phone calls: In case your account balance falls beneath the essential margin amount, you’ll need to deposit additional resources immediately. If you fall short to do so, your positions could possibly be liquidated in a decline.

Interest Charges: The desire on borrowed money can include up, particularly if you keep positions for an prolonged period of time. These fees can eat into your gains.

Sector Volatility: Margin investing is particularly dangerous in unstable marketplaces, where by sudden value swings can result in immediate losses.

Finest Techniques for Margin Buying and selling

Commence Modest: If you’re new to margin trading, get started with a small level of leverage to minimize danger. When you obtain working experience, you'll be able to gradually improve your publicity.

Use Cease-Loss Orders: Stop-loss orders immediately near your posture if the market moves in opposition to you by a specific quantity, helping to Restrict losses.

Monitor Your Positions Intently: Often Look at your account balance along with the performance of the positions to prevent unpredicted margin phone calls.

Teach Your self: Continually educate by yourself on current market traits, technological Assessment, and investing tactics to help make knowledgeable selections.

Keep a Dollars Reserve: Retain a dollars reserve as part of your margin account to address opportunity margin phone calls and stay clear of compelled liquidations.

Summary

Margin trading provides substantial opportunities for traders to enhance their sector publicity and most likely enhance returns. Even so, In addition, it comes with sizeable pitfalls, which makes it essential to approach it with warning and also a reliable understanding of how it works. By commencing little, applying chance management procedures, and staying knowledgeable, you'll be able to navigate the complexities of margin trading and do the job in the direction of reaching your monetary aims.

No matter whether you’re a novice trader or have some practical experience below your belt, mastering the art of margin investing necessitates discipline, knowledge, plus a effectively-considered-out approach. Using these applications in hand, it is possible to make the most of the benefits even though mitigating the hazards, paving the way for fulfillment in the world of margin trading.

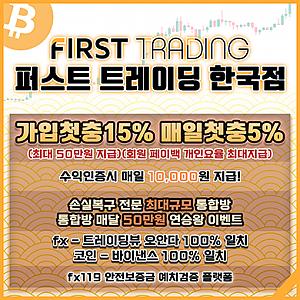

Check out more details here: 해외선물